Commercial Flood Insurance and Coverage in Carrollwood, Temple Terrace, Lutz, Westchase, Tampa, Greater Northdale, FL, and the Surrounding Areas

Many different perils can affect a commercial property in blank, from fires to vandalism to storm damage and more. One of the perils that is commonly not included in a commercial insurance policy is for flooding, yet having commercial flood insurance from Mynatt Insurance Agency is a crucial part of risk mitigation. Floods are more unique in the frequency of when they happen, as well as the extent of damage and area affected when they do happen. Because of these differences, when compared with many other perils, flood insurance has been a separate policy that is optional coverage. There may be circumstances where flood insurance is required, such as having a mortgage on a commercial property, but even if it isn’t required, having flood insurance is a good idea. Contact our team today to learn more about adding commercial flood insurance to your risk management approach.

Many different perils can affect a commercial property in blank, from fires to vandalism to storm damage and more. One of the perils that is commonly not included in a commercial insurance policy is for flooding, yet having commercial flood insurance from Mynatt Insurance Agency is a crucial part of risk mitigation. Floods are more unique in the frequency of when they happen, as well as the extent of damage and area affected when they do happen. Because of these differences, when compared with many other perils, flood insurance has been a separate policy that is optional coverage. There may be circumstances where flood insurance is required, such as having a mortgage on a commercial property, but even if it isn’t required, having flood insurance is a good idea. Contact our team today to learn more about adding commercial flood insurance to your risk management approach.

Why Businesses Need Flood Insurance Coverage

The simple fact is that while your commercial property insurance covers a lot of different issues, flooding is not one of them. The prevalence of fires, theft, and other incidents is much higher than flooding, and often those incidents are localized to just a single property or portion of a property. Flooding, by comparison, often covers a wide area and affects many properties and buildings; however, it doesn’t happen nearly as often as the other incidents mentioned and covered with regular property insurance.

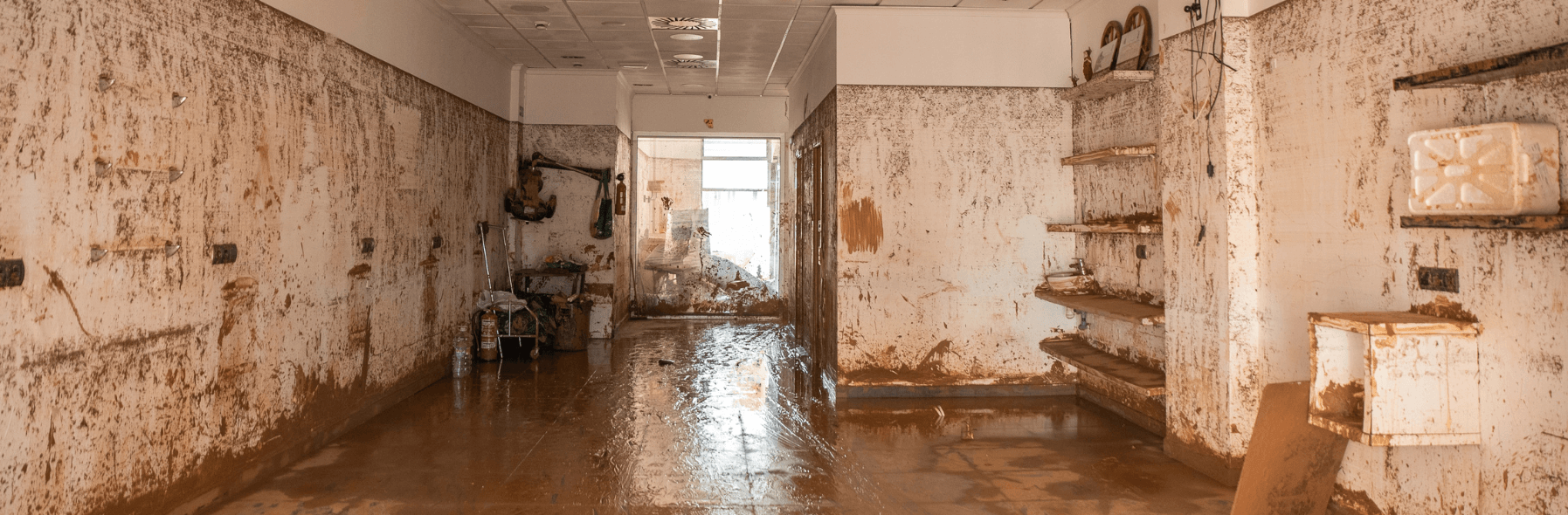

Even just an inch or two of flooding can cause a significant amount of damage to your property. Flooding doesn’t stay localized in just a room or two, but spreads throughout the entire building, meaning that every wall in the building is affected, as well as any flooring, doors, and other items. Flooding damage can quickly add up, which is why flood insurance can be crucial to prevent financial hardships.

Get Tailored Commercial Flood Insurance Coverage for Your Florida Business

Get Tailored Commercial Flood Insurance Coverage for Your Florida Business

Every property is unique in several ways, and this means you should obtain tailored commercial flood insurance coverage that suits your specific situation. There are a number of factors that will influence your commercial flood insurance, including things like the proximity to oceans, rivers, and other flooding sources; the characteristics of the building itself; the elevation of the property in relation to the surrounding area; and even prior claims can be factored into things.

Insurance is designed to provide financial protection from a variety of perils in general, and commercial flood insurance coverage is no exception. Because of the nature of flooding, this needs to be a separate insurance policy, and our team at Mynatt Insurance Agency can help you get the right coverage to protect against this devastating incident.

Contact us today to learn more about adding commercial flood insurance.